The

local housing market reached new record highs in 2018 although it cooled off in

the second half, likely due to the political climate, the jittery stock market

and the cancellation of the free trade agreement. The number of offers on

listings declined in the second half of the year but houses generally were

selling at or above the list price excluding the upper-end listings. The strong

economy coupled with still historically low interest rates motivated buyers to

buy before interest rates climb higher. However Chinese buyers were less active

in the local market in 2018 due to their government's tightening of money

outflow and the drop of the Chinese stock market.

The

current hot real estate market cycle could be due for a pullback. It has been

10 years since the last market cycle ended in 2008. Average and median prices

have more than doubled, and affordability is nearing lows that typically appear

at the end of a cycle. Some economists predict that the next housing

recession will begin in 2020. They note that, if the Fed raises rates too

quickly, it could slow down the economy and thus lead to a recession. As

discussed further below I believe the local market will remain strong in 2019.

|

Median home

prices increased 8.5% in Palo Alto to $3,200,000, 14% in Menlo Park to

$2,600,000, 40% in Atherton to $6,650,000, 12.6% in Los Altos to $3,400,000,

+25% in Los Altos Hills to 4,850,000, 17% in Mountain View to,3,320,000, 11%

in Portola Valley to $3,330,000, and 39% in Woodside to $3,262,500.

The charts below show 2018 sales data for local area communities, including median sales prices, sale to list price ratios and prices per square foot.

Challenges

to Home Sales in 2019

The Positives in 2019

2019 Real Estate Industry Outlook

I am optimistic about the economy and the housing market as the

new year begins.

High demand and robust economic conditions are reasons to be hopeful and rising

interest rates alone may not slow down the market. Unless there are major

changes in the fundamentals of the economy or significant political upheaval,

prices will continue to rise. I expect our local market to increase 7-8% in

value

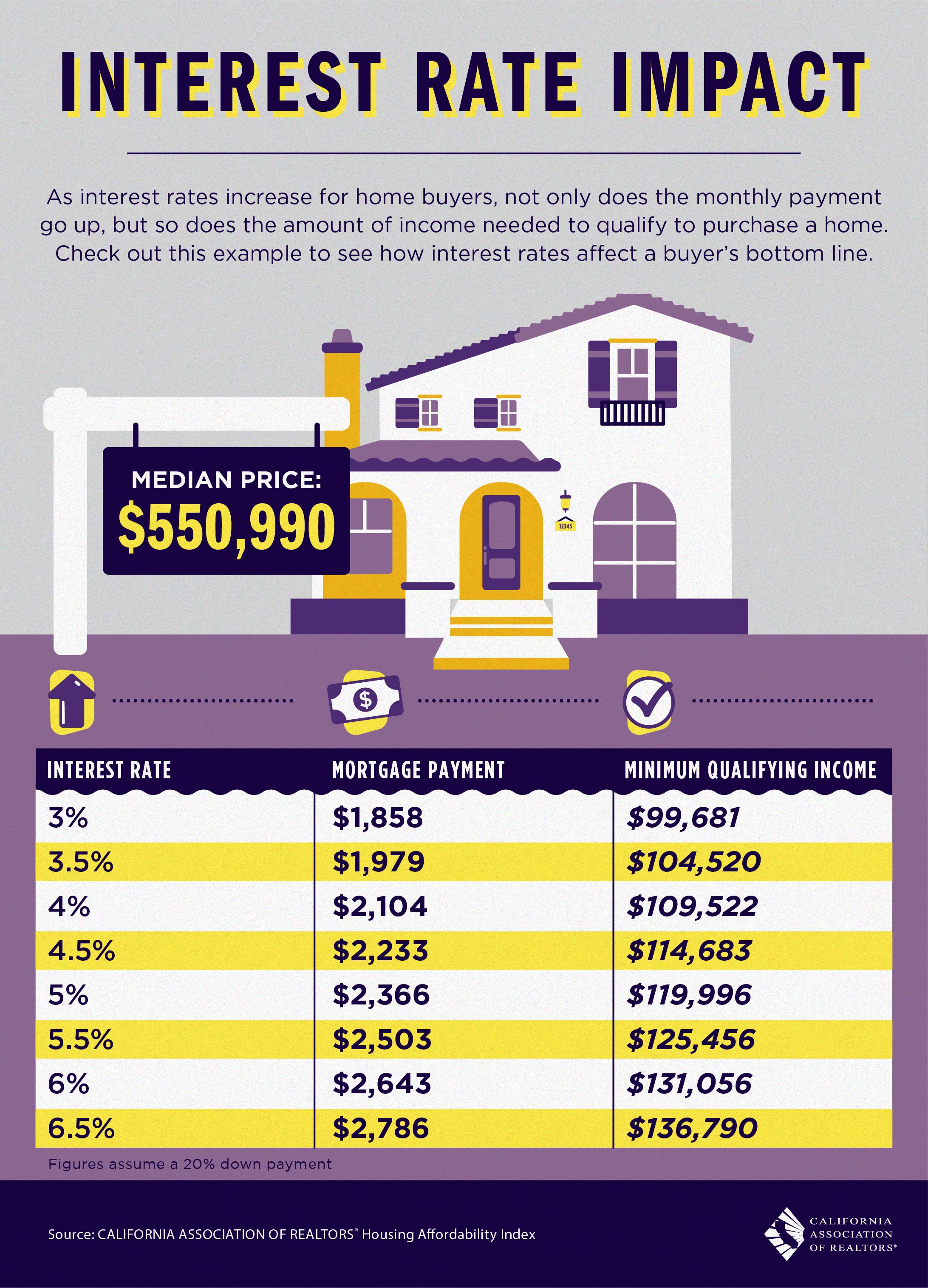

Here's the bottom line:

For buyers, interest rates will rise in 2019 but will

remain at near historic lows and 2019 will be a better year to buy a home.

Home sellers need to be cognizant that buyers are more

price sensitive now. You can still sell your home for a strong price if

you price it competitively.

Please share my semi-annual report with your friends who might be

looking to buy or sell their home. I will be happy to answer any questions or

discuss in further detail the state of the real estate market

|